All Categories

Featured

Table of Contents

Choosing to buy the realty market, stocks, or various other standard kinds of possessions is prudent. When making a decision whether you need to purchase accredited financier chances, you ought to balance the trade-off you make in between higher-reward prospective with the absence of reporting demands or regulatory openness. It must be stated that personal positionings entail higher degrees of risk and can on a regular basis stand for illiquid financial investments.

Specifically, nothing here needs to be analyzed to state or indicate that past outcomes are an indication of future performance nor ought to it be analyzed that FINRA, the SEC or any kind of various other safety and securities regulator accepts of any one of these safety and securities. Additionally, when reviewing personal placements from sponsors or firms offering them to approved capitalists, they can provide no service warranties expressed or suggested regarding precision, completeness, or results obtained from any information supplied in their discussions or presentations.

The business must provide details to you via a document called the Private Positioning Memorandum (PPM) that supplies a much more thorough explanation of costs and threats related to joining the financial investment. Passions in these bargains are only offered to individuals that certify as Accredited Investors under the Securities Act, and a as specified in Section 2(a)( 51 )(A) under the Company Act or a qualified staff member of the administration business.

There will not be any kind of public market for the Interests.

Back in the 1990s and very early 2000s, hedge funds were known for their market-beating efficiencies. Normally, the supervisor of an investment fund will establish apart a part of their available properties for a hedged wager.

What is Real Estate Syndication For Accredited Investors?

A fund manager for an intermittent market might commit a portion of the assets to supplies in a non-cyclical industry to offset the losses in situation the economic climate tanks. Some hedge fund supervisors make use of riskier approaches like utilizing borrowed cash to acquire even more of a possession just to increase their prospective returns.

Similar to shared funds, hedge funds are professionally handled by job investors. Hedge funds can use to various investments like shorts, choices, and derivatives - Passive Real Estate Income for Accredited Investors.

Can I apply for High-return Real Estate Deals For Accredited Investors as an accredited investor?

You might choose one whose investment approach lines up with your own. Do remember that these hedge fund money managers do not come inexpensive. Hedge funds commonly charge a fee of 1% to 2% of the possessions, along with 20% of the revenues which works as a "efficiency fee".

You can acquire an asset and obtain awarded for holding onto it. Recognized capitalists have more opportunities than retail investors with high-yield financial investments and beyond.

How can Private Property Investment Opportunities For Accredited Investors diversify my portfolio?

You have to meet at the very least one of the complying with criteria to come to be a certified capitalist: You need to have over $1 million total assets, omitting your key house. Service entities count as certified capitalists if they have over $5 million in properties under management. You must have a yearly income that surpasses $200,000/ year ($300,000/ yr for companions submitting with each other) You must be a registered financial investment consultant or broker.

Therefore, approved investors have more experience and money to spread throughout assets. Approved capitalists can seek a wider array of possessions, but much more selections do not ensure higher returns. A lot of financiers underperform the marketplace, consisting of recognized financiers. In spite of the greater condition, recognized capitalists can make substantial blunders and do not have access to insider details.

Crowdfunding gives accredited capitalists a passive role. Genuine estate investing can assist replace your earnings or bring about a quicker retired life. Furthermore, investors can build equity through favorable cash money flow and building appreciation. Genuine estate buildings need significant maintenance, and a great deal can go wrong if you do not have the appropriate group.

Why is Accredited Investor Real Estate Deals a good choice for accredited investors?

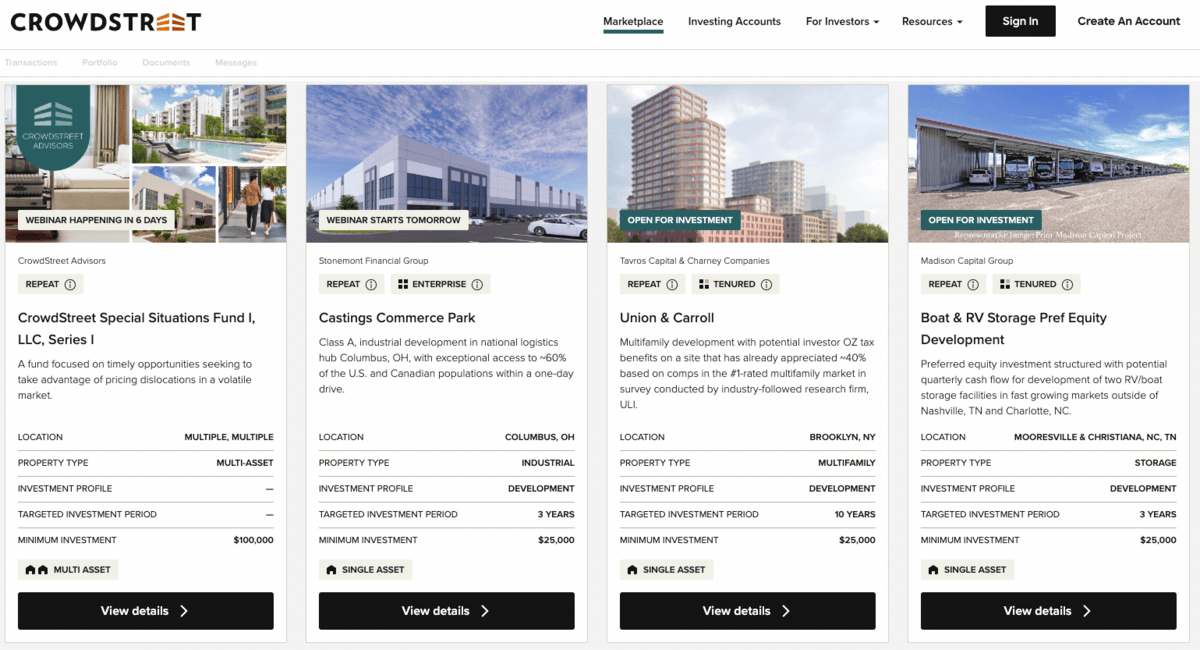

Real estate distributes pool cash from certified investors to buy homes straightened with well established objectives. Recognized capitalists merge their cash together to finance purchases and property advancement.

Actual estate investment counts on have to distribute 90% of their taxed income to shareholders as dividends. REITs permit investors to expand promptly throughout many property courses with really little resources.

Who has the best support for Exclusive Real Estate Crowdfunding Platforms For Accredited Investors investors?

Capitalists will certainly benefit if the supply rate climbs since exchangeable financial investments offer them more eye-catching entry points. If the stock topples, financiers can decide against the conversion and protect their finances.

Table of Contents

Latest Posts

Property Taxes Foreclosure

Tax Sale Property List

Tax Deed Foreclosure

More

Latest Posts

Property Taxes Foreclosure

Tax Sale Property List

Tax Deed Foreclosure